I have a feeling I may make another purchase this month and I have my eye on a few names including IBM, BBL, T, KMI, CVX, and XOM. Hopefully Santa is good to me so I can get some shares while there's a fire sale! :-o

I purchased 29 shares of GlaxoSmithKline (GSK) @ $42.39

GlaxoSmithKline plc (GSK) is a British multinational pharmaceutical, biologics, vaccines and consumer healthcare company which has its headquarters in Brentford, London. As of March 2014, it was the world's sixth-largest pharmaceutical company. GSK is engaged in the creation and discovery, development, manufacture and marketing of pharmaceutical products, including vaccines, over-the-counter (OTC) medicines and health-related consumer products. GSK’s principal pharmaceutical products include medicines in therapeutic areas: respiratory, anti-virals, central nervous system, cardiovascular and urogenital, metabolic, antibacterials, oncology and emesis, dermatology, rare diseases, immuno-inflammation, vaccines and human immunodeficiency virus (HIV). The Company operates in three primary areas of business: Pharmaceuticals, Vaccines and Consumer Healthcare.

GSK Stock Chart

GIS Basic Statistics

- Ticker Symbol: GSK

- PE Ratio: 14.3

- Yield: 5.94%

- Payout Ratio: 90%

- Market cap: $99b

- Beta: 0.86

- Website: http://www.gsk.com

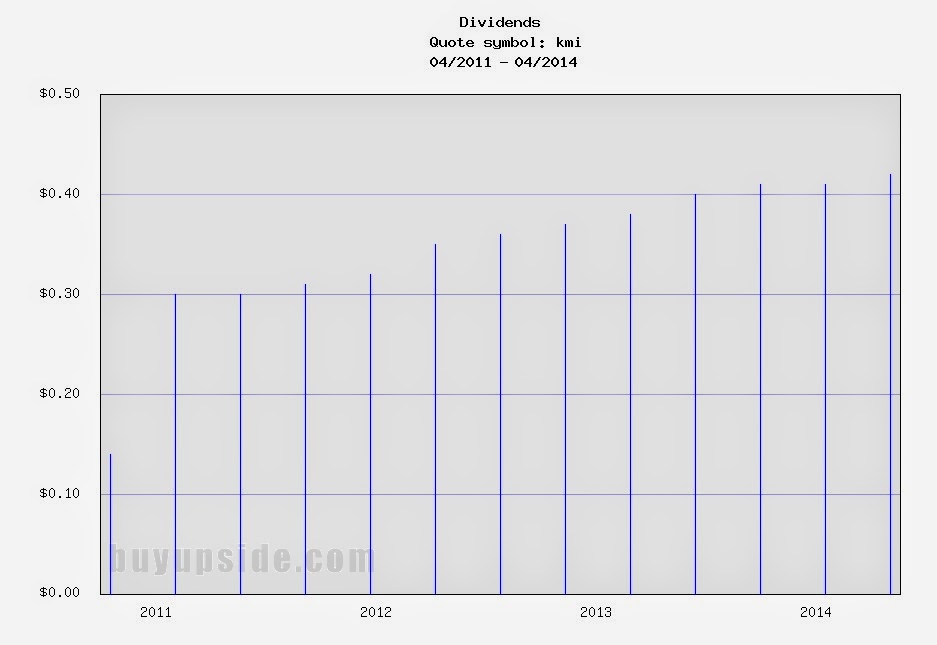

GSK Dividend Growth

Note the crazy dividend is due to currency fluctuations but the trend is upwards at around 6.5% in the past 5 yrs.