Today I purchased another 31 shares of Kinder Morgan (KMI) at $37.46 which now gives me a grand total of 93 shares. I would have loved to buy this at the prices we saw in April but KMI has been on a roll as the rest of the markets seem to have been.

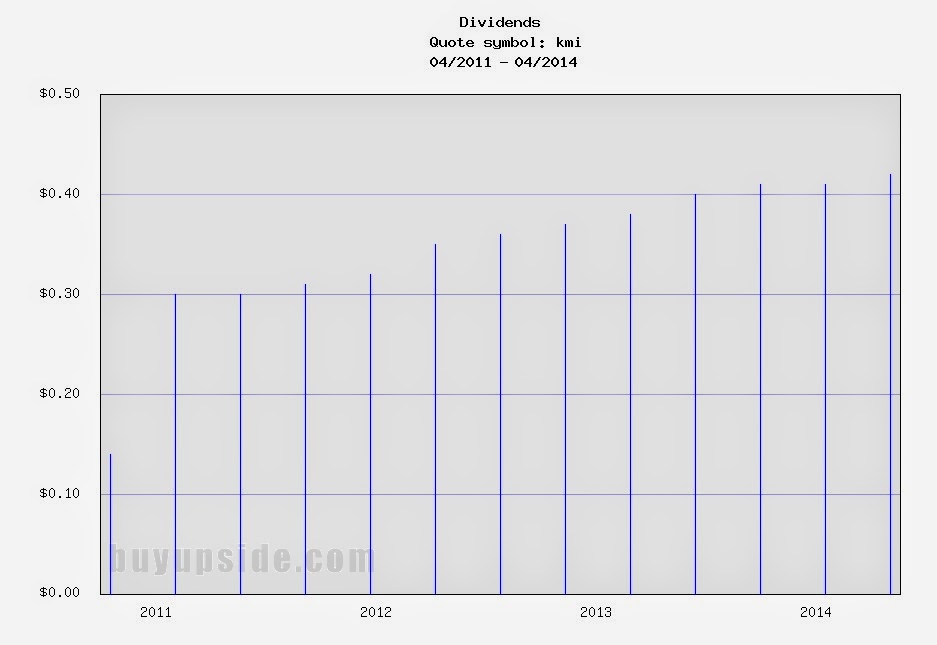

This purchase comes just days after KMI announced their 2nd quarter results, however my purchase had little to do with the results. KMI did declare a $0.43 per share dividend, up 2.38% from last quarter's $0.42, and up 7.5% from last year's $0.40 per share. I was looking to purchase an August dividend payer for next month and had my eye on a couple of stocks but ultimately went with KMI since they are raising the dividend next payment.

Kinder

Morgan, Inc. owns and operates energy transportation and storage assets

in the United States and Canada. The company owns an interest in or

operates approximately 75,000 miles of pipelines and 180 terminals. Its

pipelines transport natural gas, gasoline, crude oil, CO2 and other

products, and its terminals store petroleum products and chemicals and

handle such products as ethanol, coal, petroleum coke and steel. The

company also owns the general partner and approximately 11% of the

limited partner interests of Kinder Morgan Energy Partners, L.P.,

referred to as ‘KMP.

KMI Stock Chart

KMI Basic Statistics

- Ticker Symbol: KMI

- PE Ratio: 32.9

- Yield: 4.7%

- Dividend Growth 5yr: 10%

- Payout Ratio: 139%

- Market cap: $38.6 B

- Website: http://www.kindermorgan.com

KMI Dividend Growth