Today I purchased another 31 shares of Kinder Morgan (KMI) at $37.46 which now gives me a grand total of 93 shares. I would have loved to buy this at the prices we saw in April but KMI has been on a roll as the rest of the markets seem to have been.

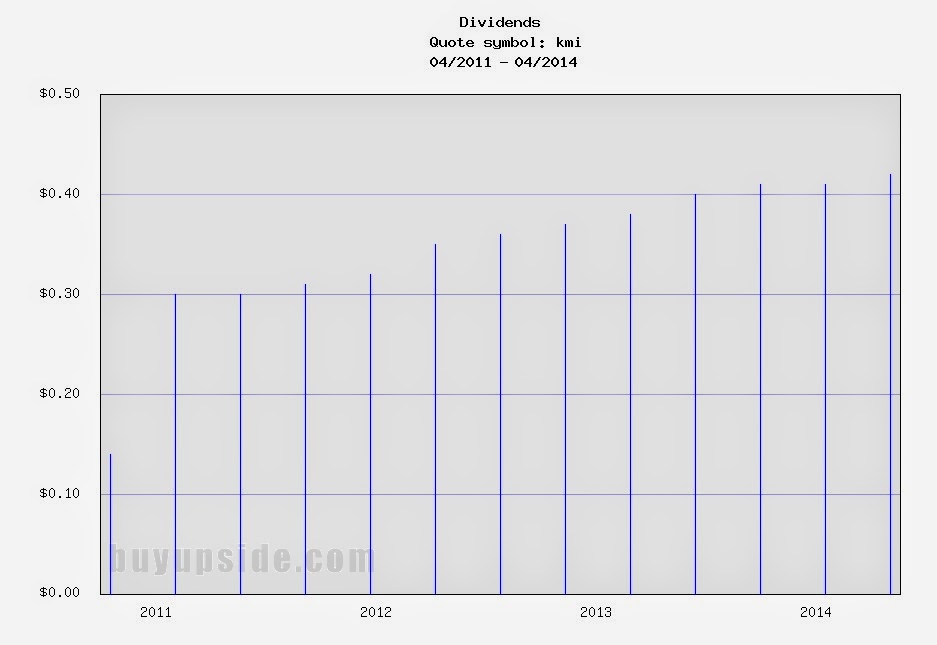

This purchase comes just days after KMI announced their 2nd quarter results, however my purchase had little to do with the results. KMI did declare a $0.43 per share dividend, up 2.38% from last quarter's $0.42, and up 7.5% from last year's $0.40 per share. I was looking to purchase an August dividend payer for next month and had my eye on a couple of stocks but ultimately went with KMI since they are raising the dividend next payment.

Kinder

Morgan, Inc. owns and operates energy transportation and storage assets

in the United States and Canada. The company owns an interest in or

operates approximately 75,000 miles of pipelines and 180 terminals. Its

pipelines transport natural gas, gasoline, crude oil, CO2 and other

products, and its terminals store petroleum products and chemicals and

handle such products as ethanol, coal, petroleum coke and steel. The

company also owns the general partner and approximately 11% of the

limited partner interests of Kinder Morgan Energy Partners, L.P.,

referred to as ‘KMP.

KMI Stock Chart

KMI Basic Statistics

- Ticker Symbol: KMI

- PE Ratio: 32.9

- Yield: 4.7%

- Dividend Growth 5yr: 10%

- Payout Ratio: 139%

- Market cap: $38.6 B

- Website: http://www.kindermorgan.com

KMI Dividend Growth

Nice purchase Captain. I hold KMP and both increased the dividends this quarter, but my exposure if not as high as yours.

ReplyDeleteCongrats.

Cant go wrong with KMI. Fairly valued, great long term hold and great dividend growth coming quarter after quarter.

ReplyDeleteKeep up the great work!

R2R

Captain, isn't KMI a MLP and have those crazy tax problems? Or is it a stock?

ReplyDeleteKMP is what your thinking of. KMI is the general partner/manager for KMP. KMI trades like a normal stock and will not produce a K-1 tax requirement.

DeleteI didn't realize about KMP's tax requirement when I purchased it early this year. I learnt about it a while later and it was too late by then :)

DeleteI purchased it early this year and still hold it. I haven't decided whether I want to hold it long term and go through this tax issue each and every year.

Same here DGJ. I was reading an article on seeking alpha and was jumping for joy at KMP....until one of the commenter said I had a file a K-1....

DeleteBut now I finally own 6 shares of KMI, thanks Captain.

What about this K-1 tax requirement if KMP is held in an IRA?

DeleteI own KMI but have not purchased any recently--too pricey. I added to it a lot last year and early this year. I don't blame you for adding more. Last year as I bought more stocks many people kept saying, "I'm waiting for a pull back." It never came--stock market up 30% for the year! No point in waiting, just keep dollar-cost-averaging.

ReplyDeleteAdding some KMI always seems to be a good idea. It's been a while since I added some but I'll probably hold off unless we see it back in the low $30's since it's currently about 5.5% of my portfolio. Great DG company and Rich Kinder is on our sides.

ReplyDeleteStrong buy, you really can't go wrong with KMI. I own KMI as well and enrolled in DRIP. I may add to my position later on once the price comes down a little bit so I can DRIP more than 1 share.

ReplyDeleteThank you Captain. I also watch the stock.

ReplyDelete