McDonald’s Corporation franchises and operates McDonald's restaurants in the United States, Europe, the Asia/Pacific, the Middle East, Africa, Canada, and Latin America. Its restaurants offer various food items, soft drinks, coffee, and other beverages, as well as breakfast menus. As of December 31, 2012, the company operated 34,480 restaurants in 119 countries worldwide and serve 69 million customers each day.

MCD Basic Statistics

- Ticker Symbol: MCD

- PE Ratio: 18.18

- Yield: 3.1%

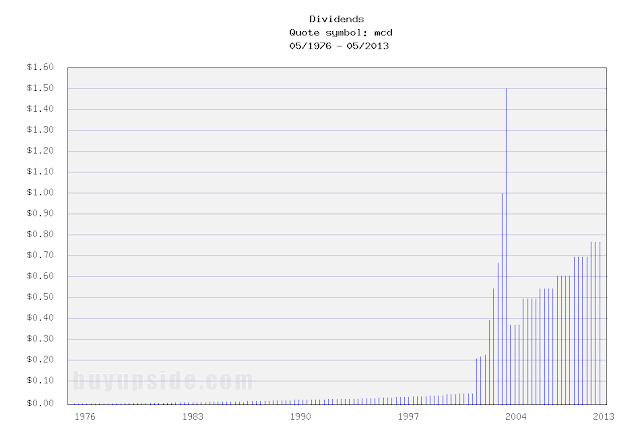

- Dividend Growth 10yr: 9.2%

- Payout Ratio: 55%

- Market cap: $98 B

- Website: http://www.mcdonalds.com