McDonald’s Corporation franchises and operates McDonald's restaurants in the United States, Europe, the Asia/Pacific, the Middle East, Africa, Canada, and Latin America. Its restaurants offer various food items, soft drinks, coffee, and other beverages, as well as breakfast menus. As of December 31, 2012, the company operated 34,480 restaurants in 119 countries worldwide and serve 69 million customers each day.

MCD Basic Statistics

- Ticker Symbol: MCD

- PE Ratio: 17.63

- Yield: 3.3%

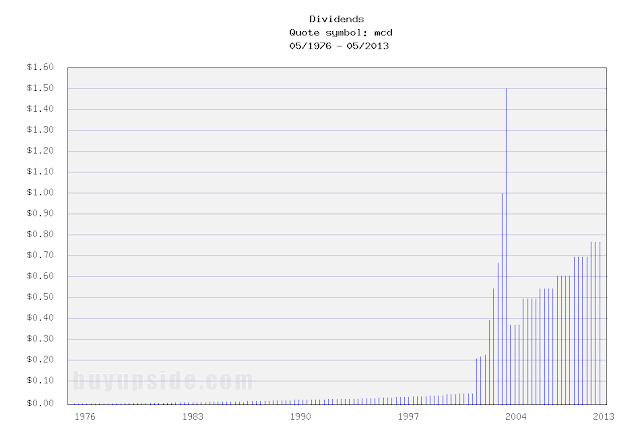

- Dividend Growth 10yr: 9.2%

- Payout Ratio: 56%

- Market cap: $97 B

- Website: http://www.mcdonalds.com

I think with MCD you won't make mistake. However I would continue saving for next purchase and wait for even lower price.

ReplyDeleteI hear ya Martin, in the future I'd love to get in cheaper but the market has not been cooperating.

DeleteI agree with Martin.

ReplyDeleteI'm also due to add to MCD. Their stock price doesn't seem as overvalued as a lot of other companies right now. It's also nice to keep dollar-cost-averaging and in this case, reducing your cost basis.

ReplyDeleteI agree, it's not cheap but the yield is better and the P/E is lower than when I bought it earlier in the year.

DeleteI think MCD is a solid choice. It's fairly valued right now, which is better than many other dividend growth stocks. It's already a decent-sized position in my portfolio, but I wouldn't mind adding more shares at some point in the near future.

ReplyDeleteI really wish I could have got in a month ago when the price dipped in to the $94 range but I didn't have the funds after purchasing KMI as they experienced a similar dip. In the long run though I don't think a couple of dollars will matter at all.

Delete