McDonald’s Corporation franchises and operates McDonald's restaurants in the United States, Europe, the Asia/Pacific, the Middle East, Africa, Canada, and Latin America. Its restaurants offer various food items, soft drinks, coffee, and other beverages, as well as breakfast menus. As of December 31, 2012, the company operated 34,480 restaurants in 119 countries worldwide and serve 69 million customers each day.

MCD Basic Statistics

- Ticker Symbol: MCD

- PE Ratio: 18.18

- Yield: 3.1%

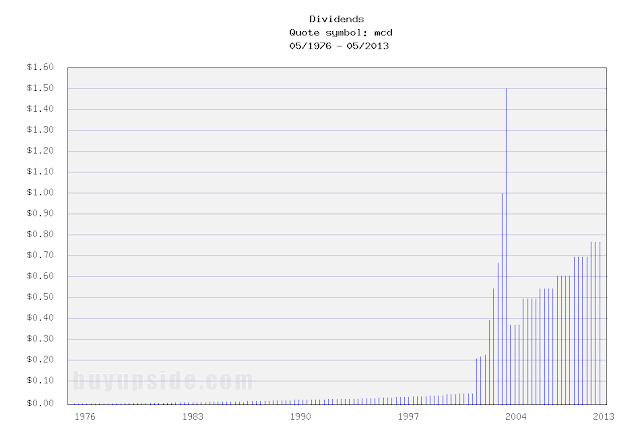

- Dividend Growth 10yr: 9.2%

- Payout Ratio: 55%

- Market cap: $98 B

- Website: http://www.mcdonalds.com

Nice purchase. I would like to add to my MCD position, although I'd prefer a price below $95. Maybe if I'm patient Mr. Market will grant my wish!

ReplyDeleteYa, MCD did drop to $96 range last week which would have been a great entry price but I didn't have the capital at the time. In hindsight I probably should have just bought my shares on margin.

DeleteI was thinking adding MCD to my portfolio too. I think any price below 100 is a good one, but then decided to add KMP. I will wait for MCD to go lower (if it ever happens). Cutting corners wherever I can to save cash to buy more shares.

ReplyDeleteHey Martin, I know the feeling I have several stocks on my watch list, now if they would only just go down! The market is on quite a roll and it's been tough to find value out there.

DeleteTrue, its hard to find something good and we wish for a drop and when the drop happens we complain and don't want the drop because we are not ready for it (I mean having enough cash for buying).

Deletenice buy with MCD. I bought in earlier this year in the low -mid 90's. You will do just fine at these prices

ReplyDeleteThanks Integrator, I think MCD is one of those stocks I'll have for many years, and I don't feel uncomfortable buying at these levels knowing that.

DeleteGreat buy, MCD is one of my favorite dividend holdings for all the reasons you've stated. As @DividendGrowthMachine said, I think $95 would be an ideal purchase price but at the current metrics, anything <100 is great for such a stable long term holding. Dividend growth for 36 consecutive years, p/e <20, and a yield >3%...win.

ReplyDeleteYa, you nailed it. Never a bad idea buying a dividend champion that meets those criteria.

DeleteI discovered your site recently and I was pleasantly surprised. I too am building my portfolio to live off the dividends. MCD is my third purchase American as well as being a aristrocrata of dividends is also an international company present in USA, Latin America, Europe and many emerging countries. No doubt it will be a company that will still be relevant in 30 years.

ReplyDeleteHave you thought about expanding your portfolio in the future with companies other than the USA?

Glad you stopped by Magallanes! I'm not totally opposed to foreign stocks. I'm actually keeping a close eye on some at the moment, Royal Dutch Shell (RDS-B)for example. However I don't want to pay any kind of foreign tax so I have to be careful that if I do make a purchase I'm not double taxed on the dividends.

Delete