CFR does have some direct exposure to oil as about 15% of their loans are connected to the oil patch. However most of these loans are safe and the company stated that only 9.8% of those loans are likely to produce a loss. It's important to note that CFR has been through this before and survived quite well.

As far as banks go I like the regional banks over the larger banks who are really under so much scrutiny especially now during election time. CFR was also able to weather the financial crisis better than most of it's larger competitors like WFC and BAC which cut their dividends during that time.

CFR Stock Chart

CFR Basic Stats

- Ticker Symbol: CFR

- Sector: Financial

- Yield: 3.4%

- Dividend Growth Streak: 23 years

- Annualized Dividend Growth 3yr: 3.5%

- Payout Ratio: 49%

- P/E Ratio: 14.1

- Market cap:$3.7 Billion

- Website: http://www.frostbank.com

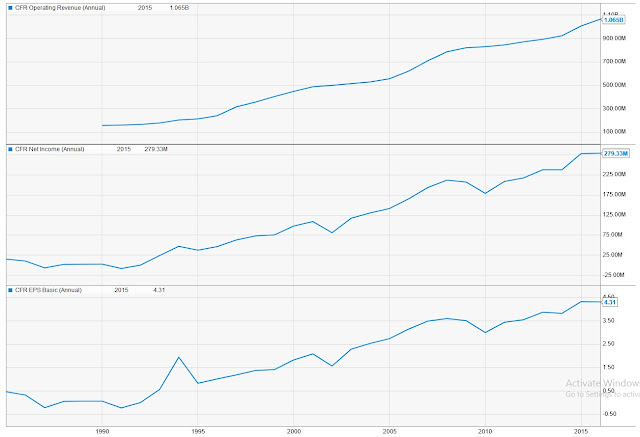

CFR Financial Growth

CFR Dividend Growth