CFR does have some direct exposure to oil as about 15% of their loans are connected to the oil patch. However most of these loans are safe and the company stated that only 9.8% of those loans are likely to produce a loss. It's important to note that CFR has been through this before and survived quite well.

As far as banks go I like the regional banks over the larger banks who are really under so much scrutiny especially now during election time. CFR was also able to weather the financial crisis better than most of it's larger competitors like WFC and BAC which cut their dividends during that time.

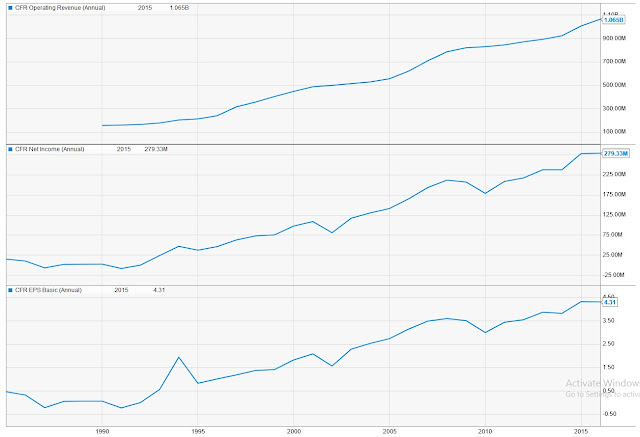

CFR Stock Chart

CFR Basic Stats

- Ticker Symbol: CFR

- Sector: Financial

- Yield: 3.4%

- Dividend Growth Streak: 23 years

- Annualized Dividend Growth 3yr: 3.5%

- Payout Ratio: 49%

- P/E Ratio: 14.1

- Market cap:$3.7 Billion

- Website: http://www.frostbank.com

CFR Financial Growth

CFR Dividend Growth

Never heard of this bank before =) . This is why I love visiting different blogs... SO MUCH TO LEARN. I will look into this one - Thanks for sharing!

ReplyDelete-TDM

Glad to have you stop by! I feel the same way and it seems like there are more and more dividend investor blogs popping up too which is great. I also love it when bloggers that I'm not familiar with like yourself comment, it gives me another opportunity to visit their blogs and learn as well. Thanks for the visit!

Deletegreat purchase!

ReplyDeleteI like both PE and yields! Prospects is great!

Cheers!

It's not perfect (what stock is though), but yes there are a lot of metrics that look good here. Thanks

DeleteThis stock is new to me. But, it looks interesting. I'm pretty heavy into financials right now so I'll pass on adding any. But I'm putting this stock on my watchlist. Thanks for sharing and congrats on the purchase.

ReplyDeleteGlad I could at least bring some attention to what is soon to be a dividend champion. Thanks for the visit IH.

Deletemmm that fits all of my screen criteria. I wonder why it isn't showing up. Thanks for the info on them CaptainD.

ReplyDeleteCheers,

DFG

You bet! Always glad to share. :-)

DeleteVery interesting pick up here. I've never heard of the company and it has over 20 years of continual dividend growth. Pretty solid fundamentals.

ReplyDeleteIn a couple of years it may get more attention with it being on the dividend champion list. My biggest criticism would be the dividend growth though. I bought right before earnings where they announced their next dividend raise which was only 2% which is much less than their historic raises . The company is going through trying times though so we'll have to see if it picks back up after oil continues to slowly rise again.

DeleteI like this as well as FLO. Great buys.

ReplyDelete